Uploading data to our Web Reporting Center

Be sure to complete the last step "Submit Forms" to ensure forms will be properly filed.

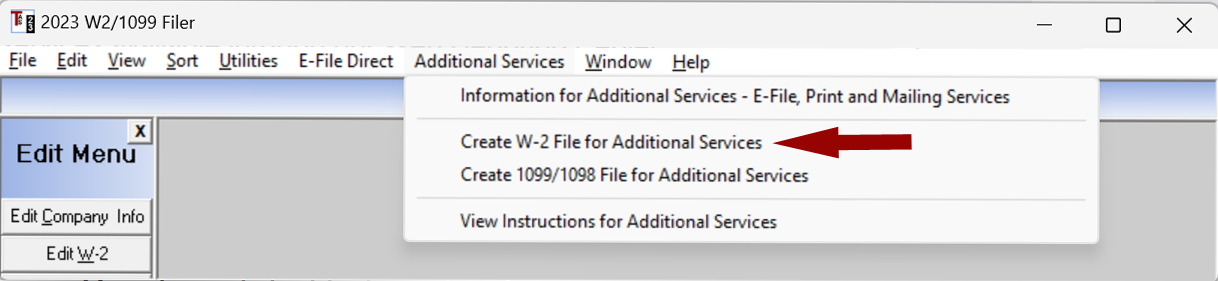

- Create a data file to upload

- Click on Additional Services and select Create W-2 or Create 1099/1098 file for additional Services

- Upload file information is the name and location of the file being created. You will need this information during the import process.

- Click the [Create File] button to create the file

- Log on to the Web Reporting Center

- Click here to access our Web Reporting Center

- Log in or Create Account

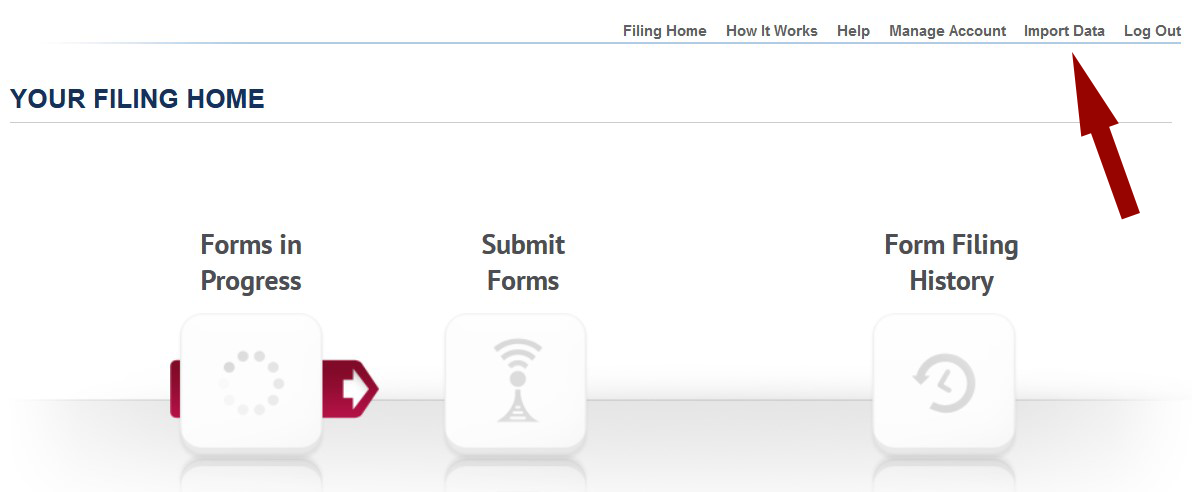

- Import the data file

- Click Import Data from the menu at the top right

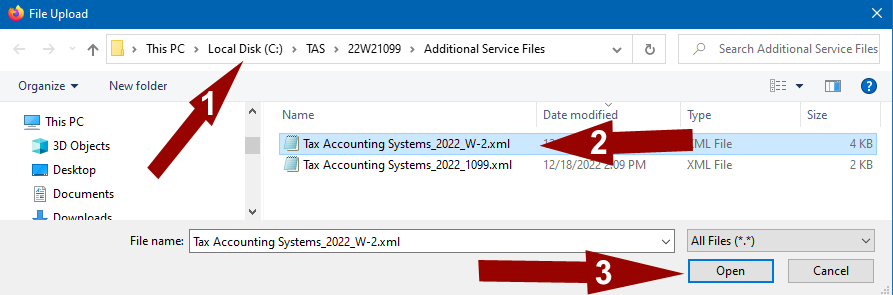

- When the [Import Data] page opens click the [Choose File] or [Browse] button to open the File Upload window and locate the file created above

- 1. Select file location - By default the files created will be in C:\TAS\22W21099\Additional Service Files

- 2. Select the file

- 3. Click [Open] button to close the window

- Click the [Import] button on the next screen to import the data file

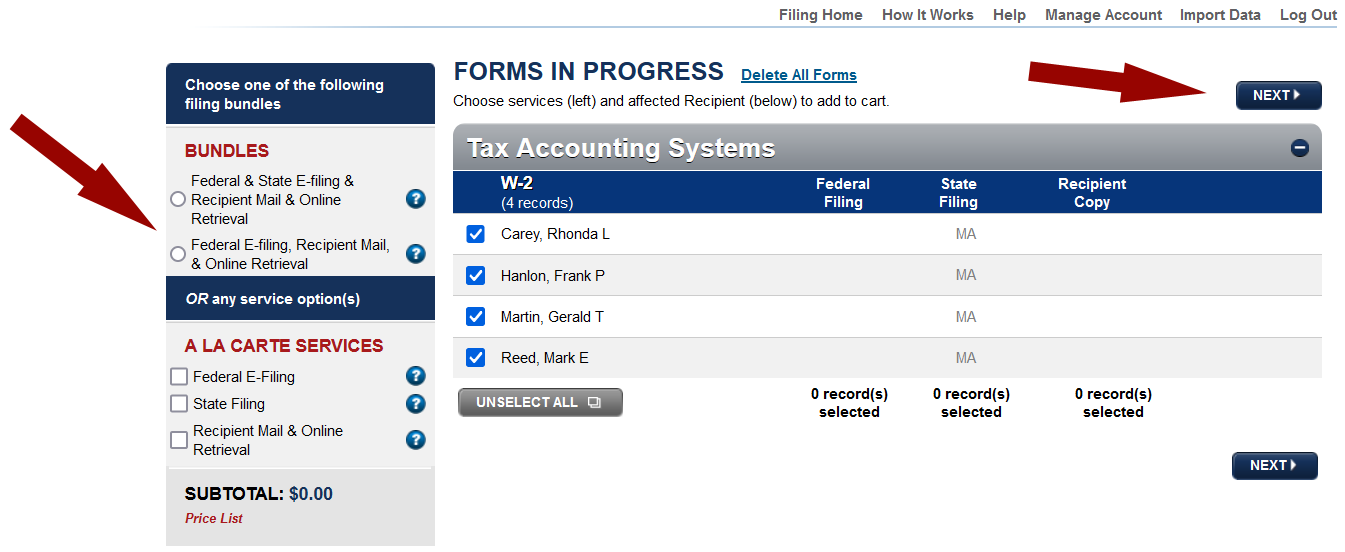

- Payer and Recipient information will be displayed on the Forms In Progress Page

- Select Services

- From the Forms in Progress page select the options needed from the list of services on the left.

- Click the [Next] button on the right.

- Any state reconciliation forms that are required will be displayed next.

- An Add/Edit Recipient Emails screen will be displayed if any recipient did not have an email address included (Optional).

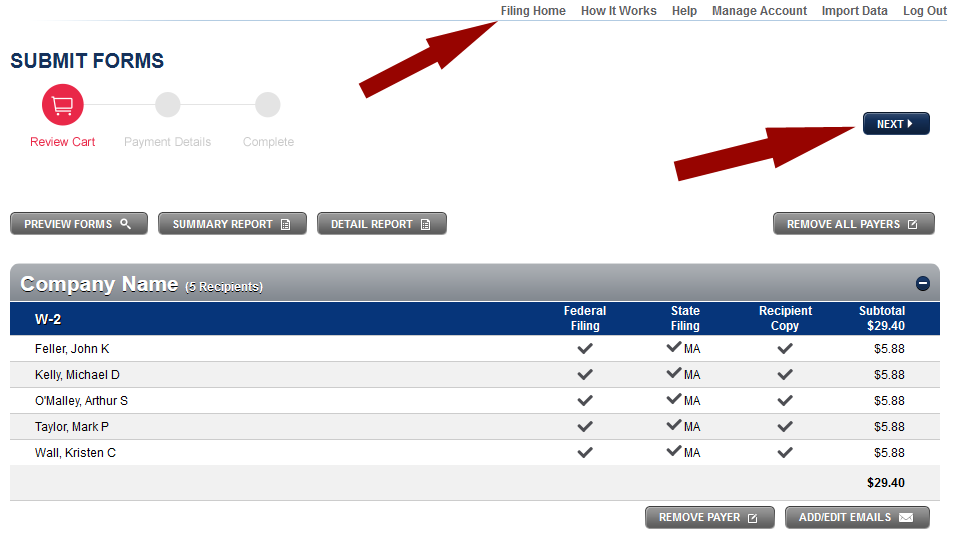

- A Submit Forms screen will show all forms ready to be submitted.

- The forms can stay on this screen allowing you to import additional companies therefore adding to the total forms.

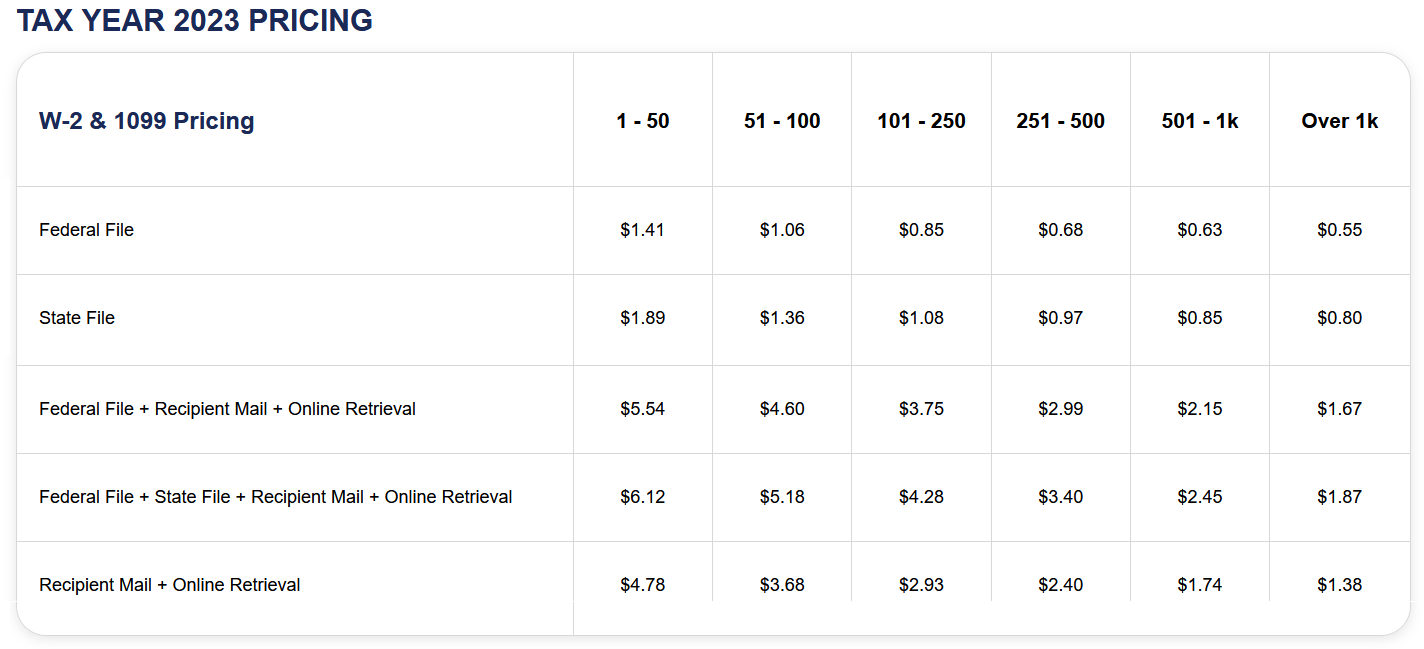

- Tiered pricing will lower your cost per form as you quantity of forms increases

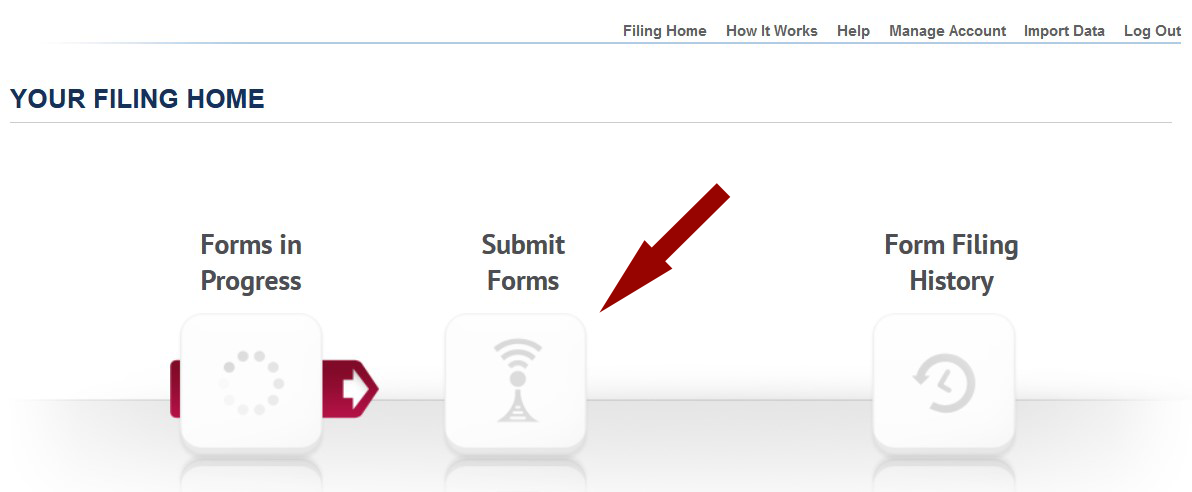

- Click Filing Home to import additional forms.

- Click [Next] to continue with checkout and submit the forms

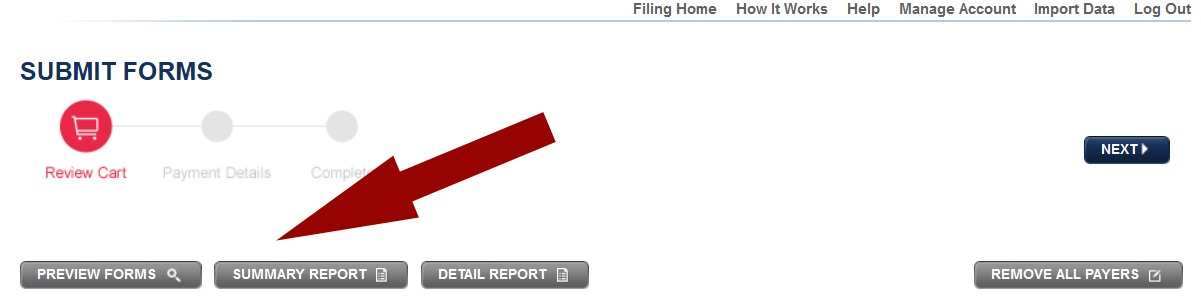

- Preview forms

- Forms can be previewed from the Submit Forms screen

- Click on Filing Home from the menu at the top right then click on Submit Forms

- From this screen you can preview forms, view summary reports or view detail reports.

- Submit Forms

- When you are ready to submit forms for e-filing and/or Printing

- Click on Filing Home from the menu at the top right then click on Submit Forms

- Click [Next] on the upper right side of the screen

- Complete the Payment Details screen and click [Pay & Submit]

- Check the Status of Filings

- Click on Filing Home from the menu at the top right then click on Form History

- Click on Check Status

- Federal (includes W-2 & 1099)

- Federal Filing Order Confirmed - Forms have been received and are currently being processed.

- Federal Filing Sent to Agency - Forms have been sent to SSA / IRS

- Federal Filing Accepted - Forms have been accepted as good by SSA / IRS

- Federal Filing Rejected - Forms have been rejected by SSA / IRS

- After submission:

- W-2 forms can take from 2 business days to several weeks to reflect a status change. The amount of time depends on the processing time at the SSA.

- 1099 forms will take 7-10 business days to reflect a status change.

- State ("XX" below will be replaced by the state code)

- XX Filing Order Confirmed - Forms have been received and are currently being processed

- XX Filing In process - Forms are being prepared to send to the State Agency

- XX Filing Sent to Agency - Forms have been sent to the State Agency

- XX Filing Completed - Forms have been accepted as good by the State Agency

- XX Filing Rejected - Forms have been rejected by the the State Agency

- After submission:

- The last status received from the state is Filing Completed unless the filing is rejected. Be sure to check back at a later date to see if the form was rejected.

- Recipient Copy

- Recipient Mailing Order Confirmed - Forms have been received and are being prepared for mailing

- Recipient Mailing Sent - Forms have been mailed to the recipients via USPS.

- Online Retrieval Confirmed - Forms are being prepared for online retrieval

- Online Retrieval Posted - The recipient forms have been posted to the online retrieval portal.